Welcome to ILS Bermuda

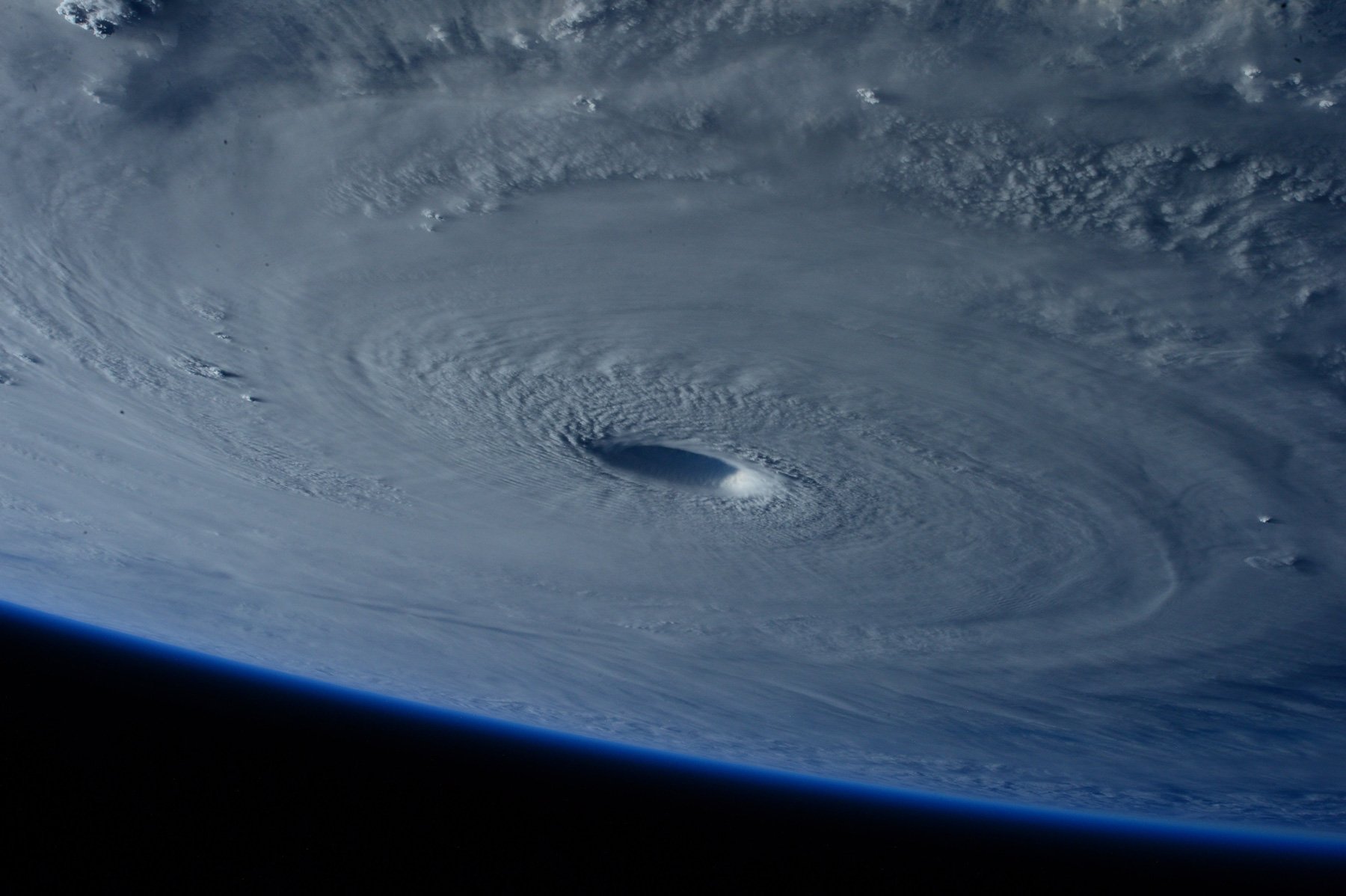

Where risk managers worldwide access innovative solutions and capacity to solve their most challenging catastrophic threats

Bermuda has been at the forefront of risk innovation for over 70 years.

As the ‘World’s Risk Capital’, Bermuda has solidified its position as a centre of excellence in respect of specialty insurance, reinsurance and bespoke innovative insurance solutions. Bermuda has a critical mass of sponsors, managers, underwriting and broking experience all underpinned by a world class commercial infrastructure which includes, solid legal infrastructure, service providers well versed in the industry and its products, a well-respected regulatory framework and an internationally recognised stock exchange.

Our Vision

When faced with emerging catastrophic threats, risk managers worldwide look to Bermuda for innovative risk and capital solutions. Learn more about our vision, strategy and risk innovation.Bermuda Market

We are the jurisdiction of choice for the development of insurance-linked solutions, matching risk with capital to grow the market in innovative ways. Learn more about Bermuda is the most popular jurisdiction for ILS market participants.Convergence Event

A premier networking experience, recognised as the leading industry event for the ILS sector, hosted annually in Hamilton, Bermuda. Learn more about the event and the perspectives it offers on current issues in the ILS and alternative capital market.Resources

Offering a wealth of knowledge on the ILS industry, its market participants, industry reports and key industry statistics. Access our resource library to learn more about Bermuda's position and contribution to climate finance and the global ILS industry.Convergence 2023

October 11 – 13

Registration Now Open

Convergence – A networking experience

October 7 – 9, 2024

Registration & Hotel Booking Portal Opening Soon

A premier networking event for the alternative reinsurance, convergence and insurance-linked securities marketplace, supported by the most-respected organisations in the ILS sector. This event attracts investors and industry participants to Bermuda, the leading jurisdiction for ILS.

bookmark Access The Market

An unmatched opportunity to access Bermuda’s alternative reinsurance, convergence and insurance linked securities marketplace.

person A Networking Experience

Connect with Bermuda’s industry leaders on the potential of ILS and unlock the value of this new asset class.

lightbulb_circle Industry Innovation

Fostering exceptional innovation in all aspects of risk transfer with a business friendly approach.